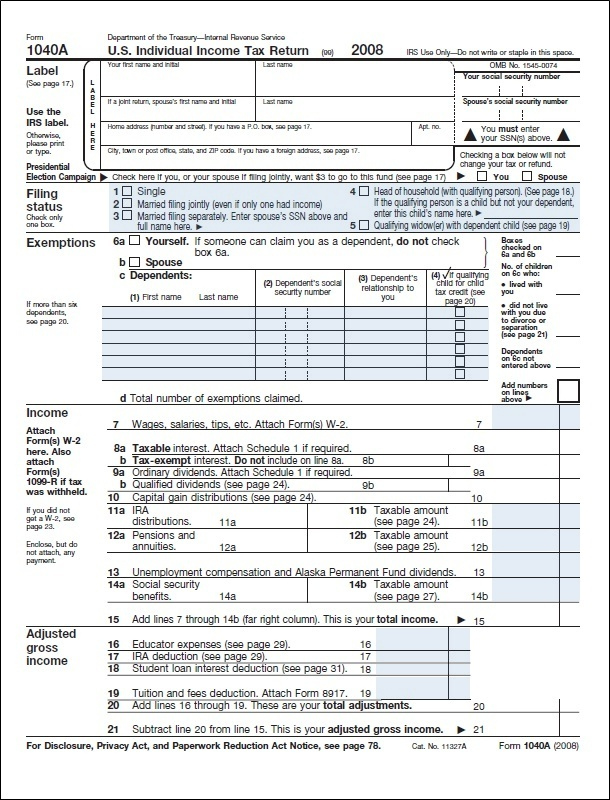

For the 2018 tax year, taxpayers who file single or married filing separately have a standard deduction of $12,000. If you file your income tax return with the 1040A, you can only claim the standard deduction. Since you can only claim one type of deduction, choose the one that results in the lowest tax liability. Because this new form consolidates the instructions for all three forms, the current instructions for the 1040A may also be formatted differently. The IRS is rolling out its new streamlined 1040, which offers a three-in-one version of the current 1040, 1040EZ and 1040A forms. New Form 1040Aīeginning with tax year 2018 (for returns filed in 2019), most taxpayers won’t have to figure out which 1040 form to use. To use the 1040A, you’ll also have to take the standard deduction, but you’ll be able to claim dependents. To use the 1040EZ, you can’t claim any dependents and you’ll have to take the standard deduction instead of itemizing your deductions.

If you’re deciding between the 1040EZ and the 1040A, dependents and deductions partly determine your choice, although there are also other considerations. If you make less than $100,000, you can choose between the 1040EZ or the 1040A, and if you make more than $100,000, the long-form 1040 will likely be your return of choice. The tipping point of income for these three forms is $100,000. Even shorter than the 1040A, the 1040EZ is the simplest form, and the 1040 form – also called the “long form” – is a bit more labor-intensive to complete. You could think of the Form 1040A (also called the "short form") as hitting a happy tax-return medium between the IRS 1040EZ form and the 1040 form.

Forms to go with 1040a series#

The 1040 tax return series includes more forms than the 1040, 1040EZ and 1040A, but these three are generally the go-to returns for most taxpayers.

0 kommentar(er)

0 kommentar(er)